In December of 2021, Twill conducted a survey of large employers and health insurance companies. We asked senior leaders to honestly and anonymously share their organization’s priorities and evaluate current strategies around digital health solutions. The responses we received were compelling, revealing some shared areas of focus and concern as well as some key differences.

Insight #1: Mental Health Is the Top Area of Focus For Both

We asked: "What health condition do you feel is most important to address with a digital solution?"

For both payers and employers, the priority health issue to address digitally is mental health: 44% of insurers and 79% of employers rated it #1.

Given that the number of adults with anxiety and/or depression in the U.S. increased 400% (from one in ten to four in ten) in the 16 months following the Covid lockdowns, this is not surprising. The butterfly effect from this could be a global increase in chronic illness, because of how the immune system responds to psychological and behavioral stressors.

Payers are increasingly under pressure from the Departments of Labor and Health and Human Services, which issued a report in January indicating that they are “failing to deliver parity for mental health and substance-use disorder benefits to those they cover.” As a result, health plans will be under more scrutiny; the departments stated their intention to more strictly enforce the Mental Health Parity and Addiction Equity Act (MHPAEA), a law that mandates that insurance providers cover mental health and substance abuse disorder benefits the same way they cover physical health benefits.

Mental health is equally critical for employers, albeit for different reasons. Countless studies have shown how stress, anxiety, and depression can negatively impact job performance and result in employees getting burned out and missing work (absenteeism) or being at work but at diminished capacity (presenteeism). This translates annually to millions of dollars in lost productivity and mental health-related disability claims.

While we’ve made progress in talking more openly about mental health (and acknowledging how it affects the workplace), there is still a significant portion of the population (17%) that fails to recognize their symptoms. Our analysis of the National Health and Wellness Survey (NHWS) data revealed that people with the highest healthcare costs also have unrecognized symptoms of depression that have not been diagnosed.

The good news is that this data suggests that both health plans and employers are actively seeking scalable solutions to expand access to care so people can become more engaged in managing their behavioral health, and they recognize the potential of digital interventions to improve outcomes and drive down costs.

Insight #2: For Employers, Engagement is the Problem; For Payers, It’s Personalization

We asked: “What is the biggest piece missing in your digital health strategy?”

- 43% of insurers said “the ability to personalize the experience.”

- 53% of employers said, “the ability to get employees engaged and retained.”

Delivering personalized digital health experiences is top of mind for health plans. If you look at blog posts and articles that quote senior executives in healthcare, the issue of personalization always comes up. The ability to customize the care journey at the member level is extremely important to payers and a gap they are trying to address.

Increasingly, digital solutions are modeling off of social media apps as a foundation to deliver personalized experiences online. Digital health communities have become an important part of that, as moderated online spaces that offer members both peer-to-peer connection and clinical resources that are specific to their particular health needs. For example, people on Twill Care, Twill's patient-centric, community support platform, have extremely high engagement rates (>2% CTRs) with sponsored content, presumably because it's personally relevant. (For comparison, average CTRs on popular social platforms like Facebook and Instagram hover just below 1%).

For employer respondents, engagement ranked highest. One of the challenges that faces any organization trying to drive adoption of digital resources is activation and retention. Many people download an app and stop using it soon after. According to Statistica, medical and health apps rank near the bottom with just 3.5% and 4% 30-day retention respectively, behind only education (2.5%) and utility apps (3.4%).

Employers know that tools that employees don’t use won’t improve outcomes. And they know EAPs suffer from abysmal utilization; the National Business Group on Health calculated the median average to be just 5.5%. So they are invested in finding digital health partners who can actually activate their workforce and keep them engaged over time.

Insight #3: Too Many Point Solutions to Choose From

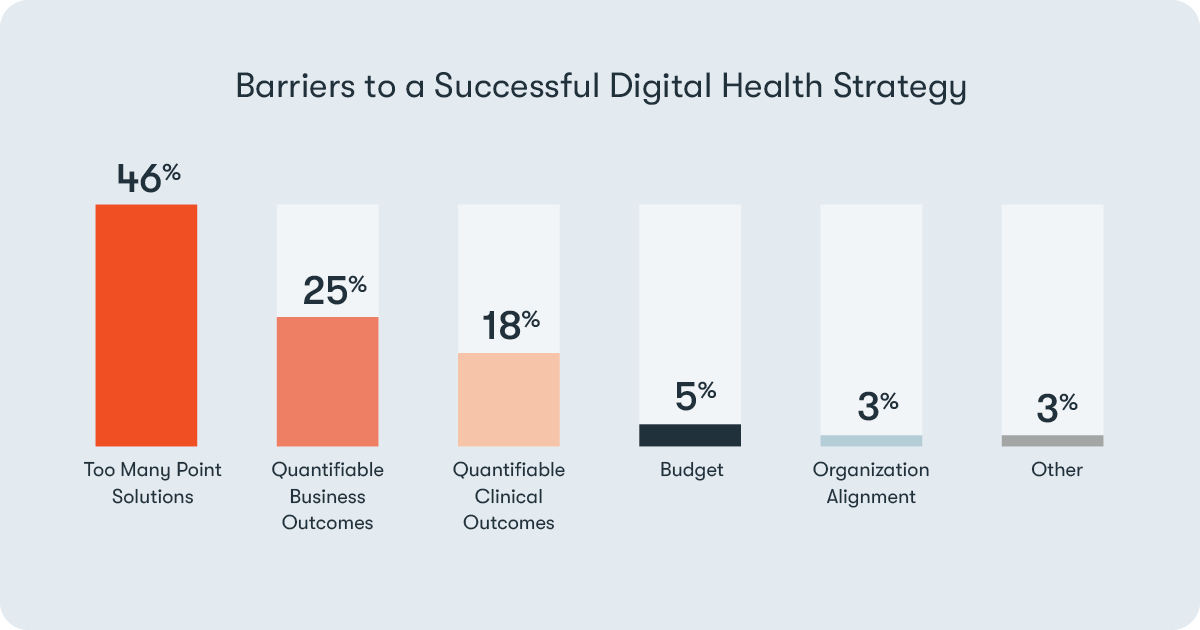

We asked: “What is the largest barrier to executing a successful digital health strategy?”

Here both employers and payers were aligned; too many point solutions was the top answer for both—46% of insurers and 27% of employers selected it.

More than 11,000 digital health tech startups have been funded over the last five years. Employers and payers are drowning in niche point solutions and struggling to differentiate between them.

At this point, both groups are wary of adding more point solutions. They want their populations to be able to navigate their benefits easily, and access everything through one unified platform that can triage them to the right level of care. Out-of-the-box point solutions make it difficult to build an ecosystem that integrates with other services and delivers a streamlined user experience that minimizes drop-offs.

Insight #4: Everyone Sees Room for Improvement

We asked: “How would you grade your organization’s digital health strategy?”

- 86% of insurers gave themselves a C or below

- 63% of employers gave themselves a C or below

Breakdown of grades:

A (We’re tight from top to bottom): 1% of insurers / 4% of employers

B (We still have things to iron out): 13% of insurers / 33% of employers

C (It’s a work in progress): 23% of insurers / 33% of employers

D (We’re not where we need to be): 56% of insurers / 21% of employers

F (We’re failing): 7% of insurers / 8% of employers

Employers graded themselves slightly better than payers, but still nearly a third gave themselves a failing grade.

What this tells me, as Head of Healthcare for Twill, is that digital health companies and entrepreneurs in this space have not just an opportunity, but a real obligation to help our partners fill these gaps. This is a pivotal moment in healthcare in this country, and employers and payers are saying loud and clear "we think we can do better." Now it's up to us as an industry to answer the call.